How to Write Off Vehicle Payments as a Business Expense |…

Yes, You CAN Write Off Your Depreciation:…

How to Correctly Write Off Depreciation | Fox…

Depreciation of Business Assets - TurboTax Tax Tips &…

A Brief Overview of Depreciation - IRS gov

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

Yes, You CAN Write Off Your Depreciation:…

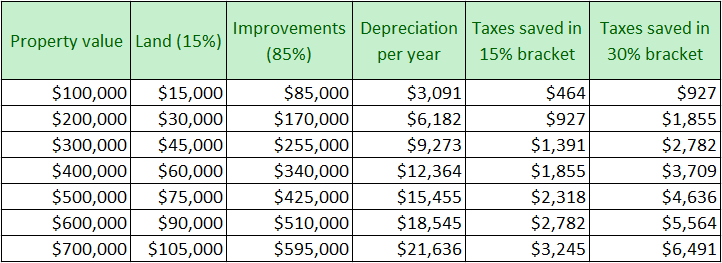

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

A Brief Overview of Depreciation - IRS gov

Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property It is an annual allowance for the wear and

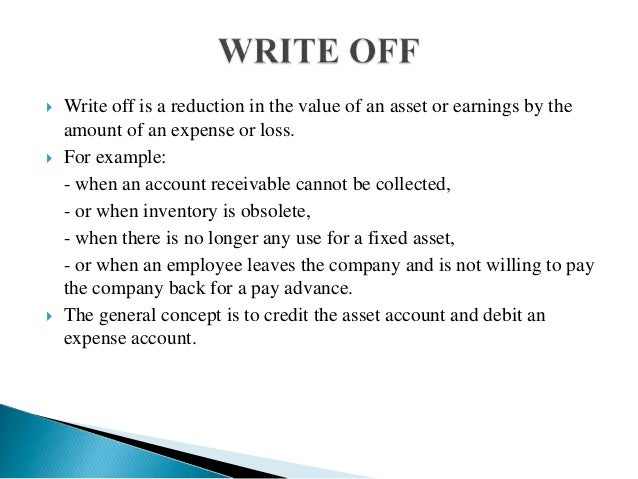

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

A Brief Overview of Depreciation - IRS gov

Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property It is an annual allowance for the wear and

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

How to Correctly Write Off Depreciation | Fox…

Mar 2013 Depreciation is a business expense applicable to the purchase of capital assets, but it can get a little tricky for owners to work out without

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

How to Correctly Write Off Depreciation | Fox…

Mar 2013 Depreciation is a business expense applicable to the purchase of capital assets, but it can get a little tricky for owners to work out without

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

How to Correctly Write Off Depreciation | Fox…

Mar 2013 Depreciation is a business expense applicable to the purchase of capital assets, but it can get a little tricky for owners to work out without

How to Write Off Vehicle Payments as a Business Expense |…

A business can write off the expenses of a business-owned vehicle and take a depreciation deduction to write down the value of the vehicle Only the portion of

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

How to Correctly Write Off Depreciation | Fox…

Mar 2013 Depreciation is a business expense applicable to the purchase of capital assets, but it can get a little tricky for owners to work out without

How to Write Off Vehicle Payments as a Business Expense |…

A business can write off the expenses of a business-owned vehicle and take a depreciation deduction to write down the value of the vehicle Only the portion of

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

How to Write Off Vehicle Payments as a Business Expense |…

A business can write off the expenses of a business-owned vehicle and take a depreciation deduction to write down the value of the vehicle Only the portion of

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

How to Write Off Vehicle Payments as a Business Expense |…

A business can write off the expenses of a business-owned vehicle and take a depreciation deduction to write down the value of the vehicle Only the portion of

Tax Deductions for Rental Property Depreciation…

Explaining Depreciation tax deductions for rental property depreciation Depreciation is the process by which you would deduct the cost of buying or improving

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

A Brief Overview of Depreciation - IRS gov

Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property It is an annual allowance for the wear and

Tax Deductions for Rental Property Depreciation…

Explaining Depreciation tax deductions for rental property depreciation Depreciation is the process by which you would deduct the cost of buying or improving

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

A Brief Overview of Depreciation - IRS gov

Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property It is an annual allowance for the wear and

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

Tax Deductions for Rental Property Depreciation…

Explaining Depreciation tax deductions for rental property depreciation Depreciation is the process by which you would deduct the cost of buying or improving

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

How to Write Off Vehicle Payments as a Business Expense |…

A business can write off the expenses of a business-owned vehicle and take a depreciation deduction to write down the value of the vehicle Only the portion of

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

Tax Deductions for Rental Property Depreciation…

Explaining Depreciation tax deductions for rental property depreciation Depreciation is the process by which you would deduct the cost of buying or improving

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

Depreciation - Investopedia

Depreciation is an accounting convention that allows a company to write-off the value of an asset over time, but it is considered a non-cash transaction

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

How to Write Off Vehicle Payments as a Business Expense |…

A business can write off the expenses of a business-owned vehicle and take a depreciation deduction to write down the value of the vehicle Only the portion of

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

How to Correctly Write Off Depreciation | Fox…

Mar 2013 Depreciation is a business expense applicable to the purchase of capital assets, but it can get a little tricky for owners to work out without

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

How to Write Off Vehicle Payments as a Business Expense |…

A business can write off the expenses of a business-owned vehicle and take a depreciation deduction to write down the value of the vehicle Only the portion of

How do I write off a fixed asset? - Questions & Answers…

Nov 2010 A write off involves removing all traces of the fixed asset from the balance sheet, If the asset is fully depreciated, that is the extent of the entry

Depreciation of Business Assets - TurboTax Tax Tips &…

Because business assets such as computers, copy machines and other equipment wear out, you are allowed to write off (or 'depreciate') part of the cost of those

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

How to Correctly Write Off Depreciation | Fox…

Mar 2013 Depreciation is a business expense applicable to the purchase of capital assets, but it can get a little tricky for owners to work out without

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

How to Write Off Vehicle Payments as a Business Expense |…

A business can write off the expenses of a business-owned vehicle and take a depreciation deduction to write down the value of the vehicle Only the portion of

Tax Deductions for Rental Property Depreciation…

Explaining Depreciation tax deductions for rental property depreciation Depreciation is the process by which you would deduct the cost of buying or improving

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

A Brief Overview of Depreciation - IRS gov

Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property It is an annual allowance for the wear and

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,

Tax Deductions for Rental Property Depreciation…

Explaining Depreciation tax deductions for rental property depreciation Depreciation is the process by which you would deduct the cost of buying or improving

Yes, You CAN Write Off Your Depreciation:…

Sep 2014 Many believe that real estate investments will have you paying tons of taxes Here s how to figure out what you can write off when it comes to

A Brief Overview of Depreciation - IRS gov

Depreciation is an income tax deduction that allows a taxpayer to recover the cost or other basis of certain property It is an annual allowance for the wear and

What is the journal entry to write off an asset? |…

Write off an asset when it is determined that it is no longer useful The journal entry is as follows: Credit (asset to be written off), Debit (accumulated depreciation),

Should you Expense or Depreciate Purchases and Assets on Your…

Depreciation is a tax protocol that requires you to divide the cost of an item you As of 2012, the IRS allows you to directly write off expenses up to $139,000,